Some hints:

Strategy usually is not the problem; sometimes financial projections don’t include important considerations; and almost always it’s execution that falls short.

At the start of a recent research project [see below to learn more] I did the proverbial Google search on “reasons for M&A failure” to see if anything has changed recently. My search returned 1.84 million results in under half a second. When I narrowed the search to include only studies, articles and blog posts since 2015, Google returned a pared down 553 thousand results. In reading the major research and scanning the headlines of other entries, there were not new topics on this list.

Having said that, the digital disruption phenomenon is adding emphasis and giving air time to issues that come up when organisations acquire businesses in order to buy (rather than build) capability. These risks stem from buying and integrating businesses that are not fully understood; and these risks are compounded by person / capability dependencies for capturing expected value from each acquisition.

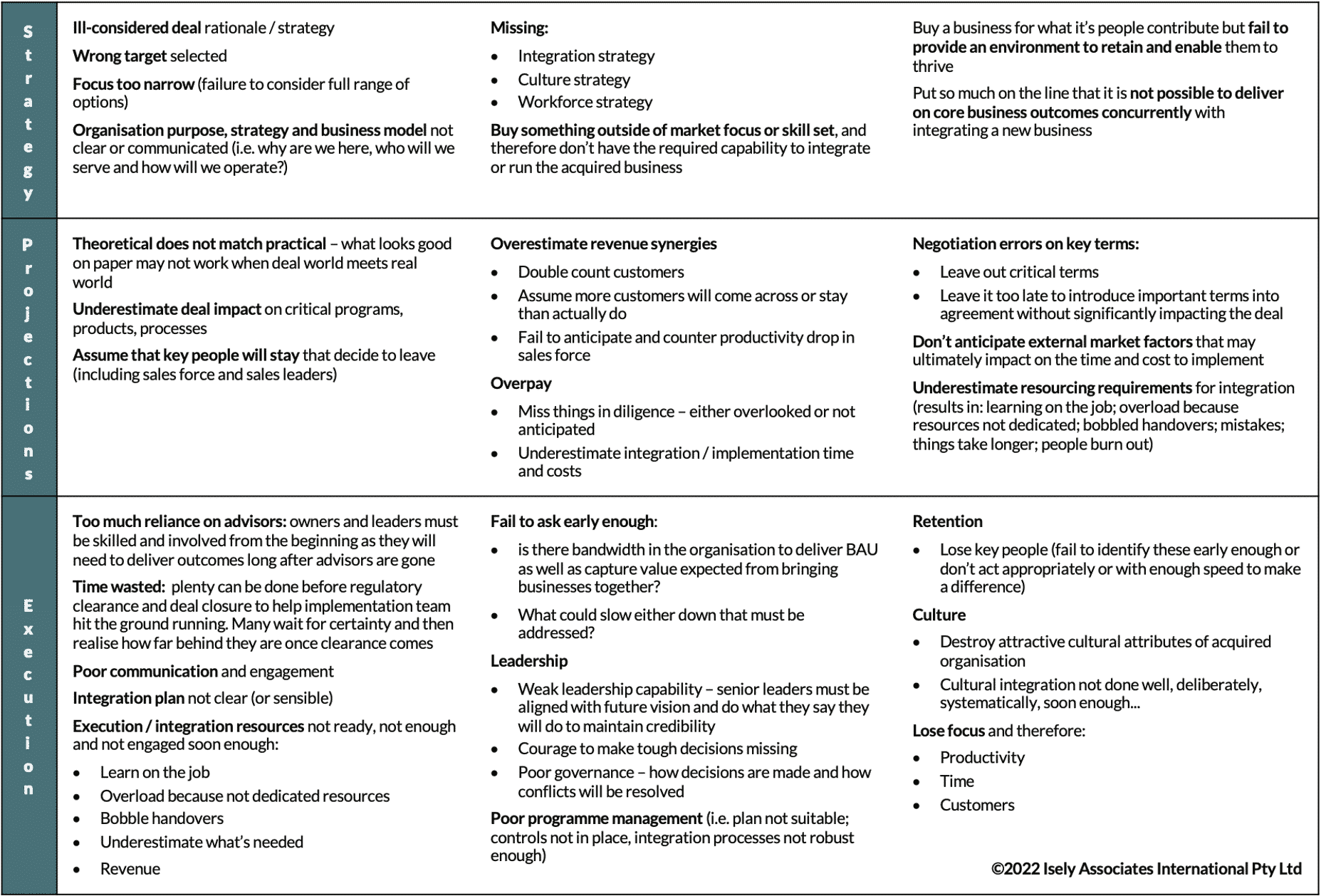

Common M&A pitfalls can be organised (roughly) into three categories – problems with strategy; inaccurate projections; and execution trouble. Following is a summary of what to look out for and address if you want to avoid deal disappointment.

More than half of these absolutely predictable pitfalls are related to how people respond to changes brought about by the deal. Time and time again dealmakers underestimate these, to the detriment of expected outcomes. Organisations either completely miss agreed targets; or they achieve expected outcomes, but at the cost of people’s wellbeing and, by definition, miss out on opportunities for creating additional value.

I sincerely believe, and we confirmed in this original research, that where organisations invest to improve the experiences people have whilst working on and living through deals, they also will directly improve deal outcomes.

A crucial step in this project was to collect the views and experiences of people who have been impacted in some way by organisations going through mergers, acquisitions, divestitures and other scenarios where businesses are joined together or taken apart. All told, we received input about 198 deals.

You are welcome to request a copy of the full research report here: https://www.iselyassociates.com.au/insights/research/ .