“Karen’s coaching style carries naturally to her consulting work with organizations, as she places great importance on learning, knowledge transfer and capability building.”

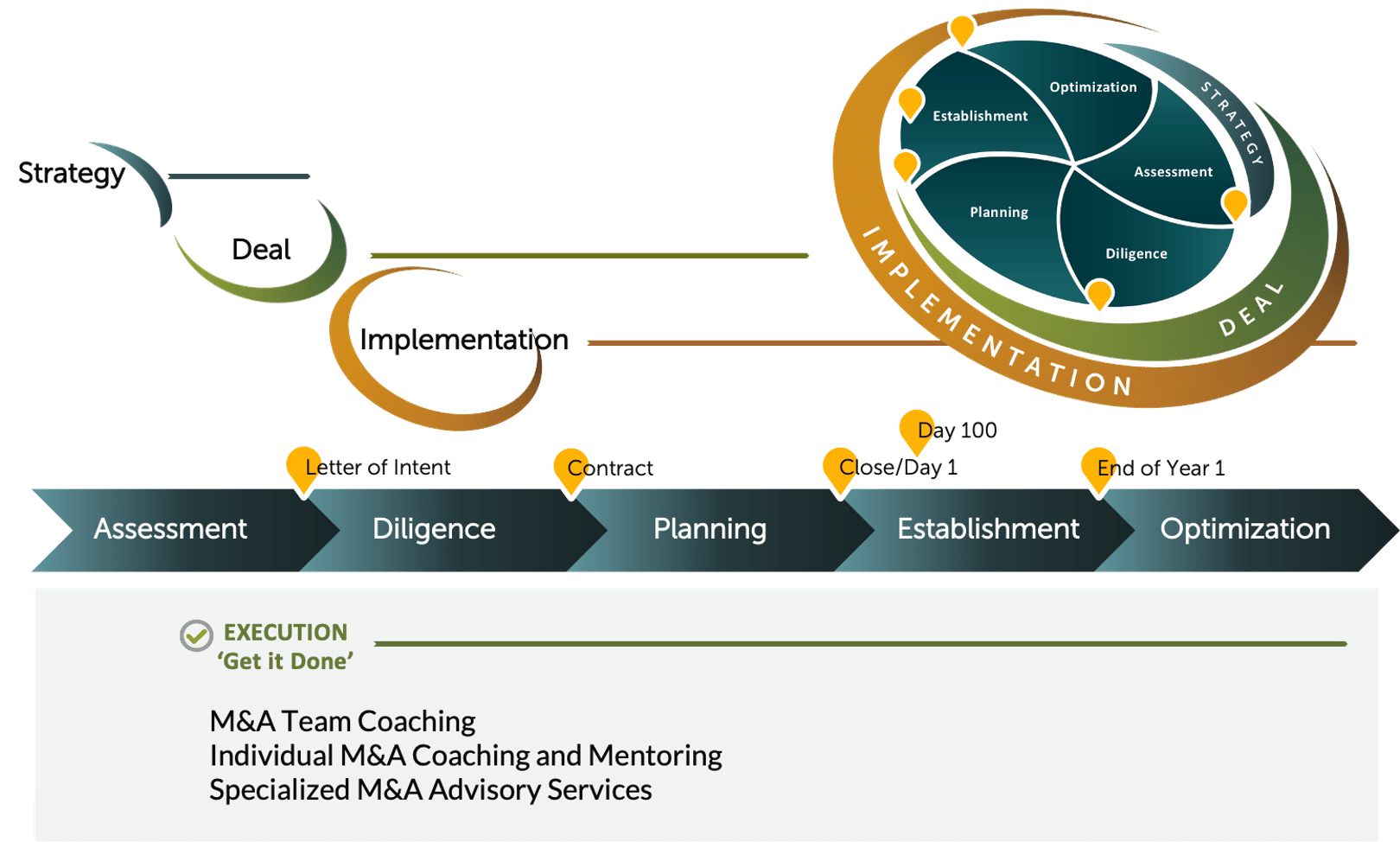

When we say Execution, we mean getting things done at all deal stages. But execution capability is especially critical at the integration stage of a merger or acquisition. Specifically, we focus on program establishment, resourcing, management and governance; tracking results; customer and salesforce management; communication program delivery; culture management; bringing supporting functions together to deliver what is required; and cultivating a positive mindset in support of achieving deal outcomes.

You may be tempted to take a “learn as you go” approach to deal execution and merger integration. However, if you don’t have the right people with the right skills and experience, in the right place at the right time, you will be only as effective as your weakest team member. Being underprepared takes a toll, if not on deal outcomes directly, then certainly on business leaders and team members who must cover the gaps.

Execution comes into its own in the planning and implementation deal stages. Safe to say that how well things can go, and ultimately how well things turn out, is influenced by early investment. Specifically, investment in Culture Management, Communication Strategy and Engagement; undertaking Diligence with Integration front of mind; drawing on deep experience for Integration Planning; and having a trusted “guide by the side” for business leaders, deal and integration teams.

Isely Associates make our best contribution to successful deal execution and merger implementation when we work as an extension of your team. We can join and contribute on a retained basis for an agreed period. Alternatively we can create and deliver a formal team and/or individual coaching program for your key resources.